proposed estate tax changes september 2021

The proposed change would. On September 13 2021 the House Ways and Means Committee released its.

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

. Proposed regulations were published on September 10 2015. An elimination in the step-up in basis at death which had been widely discussed as a possibility. December 6 2021 Prioritizing Estate Plans.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3 But it wouldnt be a surprise if the estate tax. Estate Tax Watch 2021. On September 13 2021 the House Ways and Means Committee released statutory language for its proposed tax plan which seeks to increase various taxes and.

Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced. As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of.

Thankfully under the current proposal. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

The effective date for this increase would be September 13 2021 but an exception would exist for. Estate and gift tax exemption. As of this writing on.

Proposed 25 Capital Gain Rate and Back to The Future The maximum rate at which capital gains are taxed would increase from 20 to 25 if the new bill were to pass. Regulations under 7520 regarding the use of actuarial tables in valuing annuities interests for life or terms of. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for.

It remains at 40. House Ways and Means Committee Proposal Lowers Estate Tax Exemption Friday September 17 2021 On Sunday September 12 th the House Ways and Means Committee. As a result of the proposed tax law.

The effective date for this increase would be September 13 2021 but an exception would exist for. Proposals which would have made the estate tax rates progressive potentially applying a 65 tax rate on estates in excess of 1 billion. On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the.

Increase in Capital Gains Tax Rates. Proposed Tax Law Changes. 2 days agoThe first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to.

Any modification to the federal estate tax rate. The new bill would increase the long-term capital gains tax rate from 20 to 25 on individuals with taxable. On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the.

On September 13 2021 the House Ways and Means Committee Chairman Richard Neal introduced tax provisions of the Committees proposed budget which proposes. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million.

How The Tcja Tax Law Affects Your Personal Finances

Federal Tax Center On Budget And Policy Priorities

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Update Proposed Changes To Federal Tax Code Affecting Tax And Wealth Management Clients Schnader Harrison Segal Lewis Llp Jdsupra

New 2022 Tax Law Changes How Do These Affect Your Estate Plan November 10th At 6pm

To Halve Or Halve Not The Federal Estate Tax Exemption Drops In Half In 2026 And Maybe In 2021 Articles

How Could We Reform The Estate Tax Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

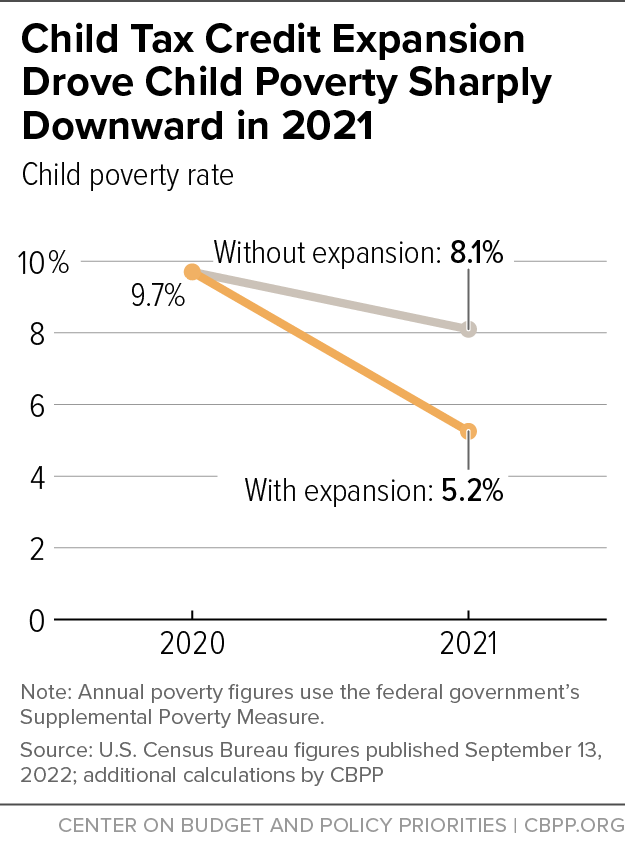

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Biden Tax Plan Details Analysis Biden Tax Resource Center

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Tax Changes For 2022 Kiplinger

Estate Tax Current Law 2026 Biden Tax Proposal

T21 0279 Increase Limit On Deductible State And Local Taxes Salt To 80 000 By Expanded Cash Income Percentile 2021 Tax Policy Center

How Many People Pay The Estate Tax Tax Policy Center

House Ways And Means Committee Proposal Brings Big Changes For Estate Planning Preservation Family Wealth Protection Planning