inheritance tax rate colorado

A local income tax has also been levied in three cities in Colorado. There is no estate or inheritance tax collected by the state.

Colorado Estate Tax Everything You Need To Know Smartasset

Any more than that in a year and you might have to pay a certain percentage of taxes on the gift.

. No estate tax or inheritance tax connecticut. There is no federal inheritance tax but there is a federal estate tax. Does Colorado have estate and inheritance tax.

Not the size of the decedents entire estate as a whole. Federal legislative changes reduced the state death. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Colorado state tax laws requiring estate or inheritance tax are pretty simple. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 the colorado estate tax is equal to this credit.

Colorado is a fairly tax-friendly state for retirees. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Impose estate taxes and six impose inheritance taxes.

Does Colorado Have an Inheritance Tax or Estate Tax. This is per IRSs basic exemption of 5 million indexed for inflation in 2017. Social Security retirement accounts and pensions are all partially taxed.

A state inheritance tax was enacted in colorado in 1927. Three cities in Colorado also have a local income tax. 1 with a 40000 exemption 13 with a 15000 exemption.

When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected. - Answered by a verified Tax Professional. Inheritance tax and inheritance tax rates are often misunderstood.

Difference between inheritance tax and estate tax. Colorado is not one of these states so anyone who dies leaving behind property in Colorado will not have to worry about estate taxes at the state level. What is the Colorado estate tax rate.

Iowa which has an inheritance. 35 Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. How much tax do you pay on inheritance.

But that there are still complicated tax matters you must handle once an individual passes away. You are welcome to call 720-493-4804 and ask for Dave. This really depends on the individual circumstances.

Twelve states and Washington DC. If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies. Does Colorado Have An Inheritance Tax.

Inheritance tax rates vary based on a beneficiarys relationship to the decedent and in some jurisdictions the amount inherited. However Colorado residents still need to understand federal estate tax laws. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

We use cookies to give you the best possible experience on our website. If an estate tax exceeds that amount the top federal tax rate is 40. Unlike estate taxes inheritance tax applies to the size of the individual gift or inheritance.

There is no inheritance tax or estate tax in Colorado. While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

The tax rate starts at 11 percent with four changes up to 16 percent. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. The state of Colorado requires you to pay taxes if youre a resident or nonresident that receives income from a Colorado source.

Even if the decedent lives elsewhere several states may assess an inheritance tax if the decedent dies in the state. The rate threshold is the point at which the marginal estate tax rate kicks in. For deaths that occur.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. The state income tax rate is.

Inheritance Taxes When a person dies and leaves behind property that property will typically be transferred to family member inheritors. The estate tax is different from inheritance tax. A state inheritance tax was enacted in Colorado in 1927.

Of Nebraskas neighbors Colorado Wyoming South Dakota and Kansas do not have an inheritance tax. No estate tax or inheritance tax Connecticut. As a matter of fact you may have to file one or more of these returns.

There is no estate or inheritance tax collected by the state. By continuing to use this site you consent to the use of cookies on your device as described in. A state inheritance tax was enacted in colorado in 1927.

Inheritance tax is a state tax only. There are three levels or rates of inheritance tax. Counties in colorado collect an average of 06 of a propertys assesed fair market value as property tax per year.

Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. Colorado does not have a death or inheritance tax but again other states do. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Inheritance tax and inheritance tax rates are often misunderstood. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. Overall Colorado Tax Picture.

Colorado has a flat income tax rate of 450. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. What is the colorado inheritance tax rate.

In 2021 federal estate tax generally applies to assets over 117 million. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. The rate threshold is the point at which the marginal estate tax rate kicks in.

Maryland is the only state to impose both.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Historical Colorado Tax Policy Information Ballotpedia

Colorado Estate Tax Do I Need To Worry Brestel Bucar

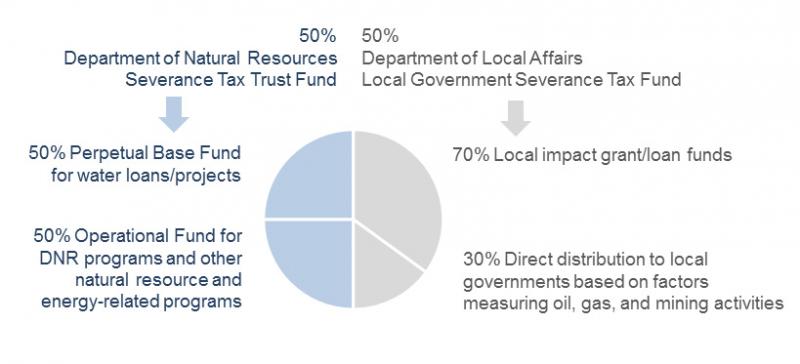

Severance Tax Colorado General Assembly

Liberty Tax Service Bookkeeping Tax Services Colorado Springs 481 Hwy 105w Suite 201 Monument Co Debt Relief Programs Credit Card Debt Relief Budgeting Money

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

Sales And Use Taxes Colorado General Assembly

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Individual Income Tax Colorado General Assembly

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

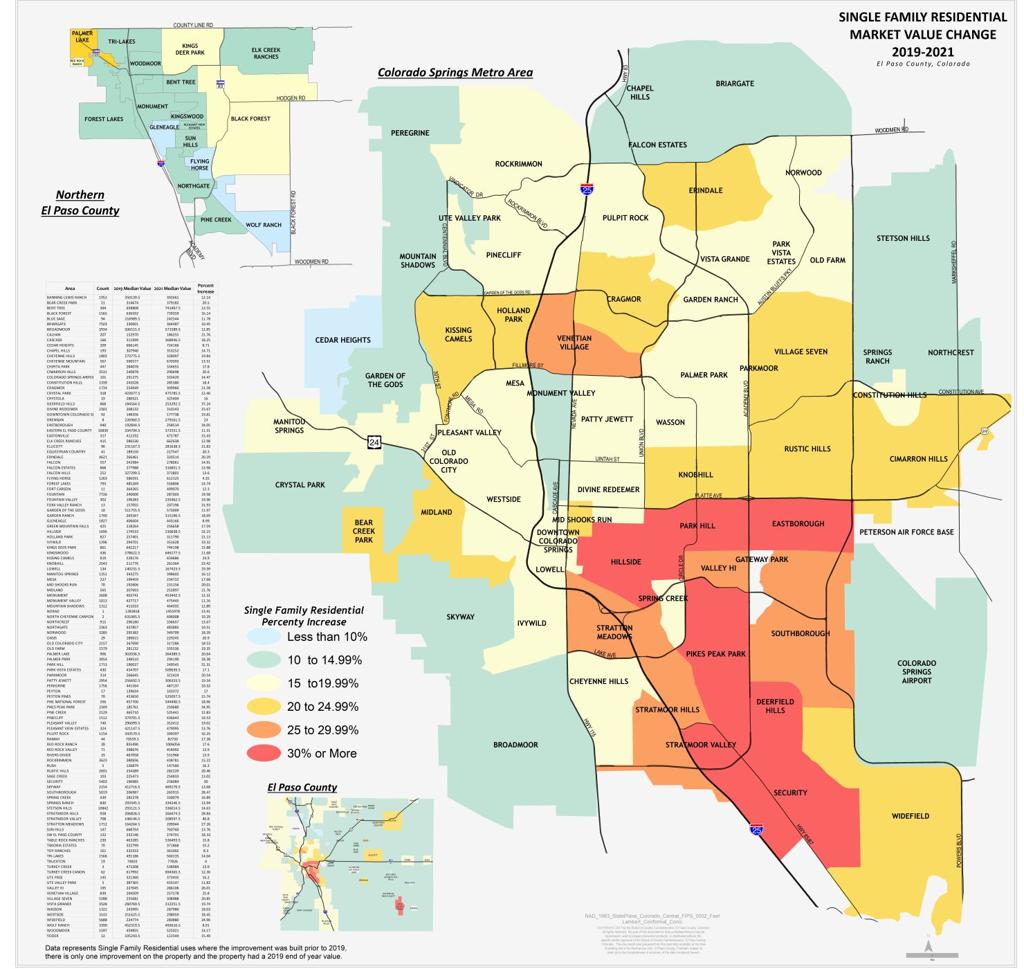

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com