jersey city property tax assessment

There is a 5 fee to provide you with a duplicate tax bill. LOS ANGELES CA 90071 Deductions.

Property Tax Comparison By State For Cross State Businesses

If you have documents to send you can fax them to the City of Jersey City assessors office at 201-547-4949.

. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Online Inquiry Payment. Like Monmouth County Tax Board Tax Records.

By using this website you acknowledge that you have read understood and agreed to the above conditions. Official records of the Jersey County Supervisor of Assessments and the Jersey County CollectorTreasurer may be reviewed at the Jersey County Government Building 200 North Lafayette St Jerseyville IL 62052. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132.

515 S FLOWER ST 49TH FL Bank Code. In the past year Ive also written about tax appeals and I also served on a team of Jersey City Together volunteers in 2017 that helped over 30 residents save over 40000 in tax expense through successful appeals. And other municipal charges through an on-.

Your canceled check is your receipt if you pay by check. On June 5th I. There are both short-term 5 years and long-term 10 years abatements.

JERSEY CITY NJ 07302 Deductions. The City of Jersey City assessors office can help you with many of your property tax. If you choose to pay your taxes at City Hall please bring your whole entire bill with you.

The long-term abatements are different though. Line auction on June 22 2021 900 am. Public Property Records provide information on land homes and commercial properties in Jersey including titles property deeds mortgages property tax assessment records and other documents.

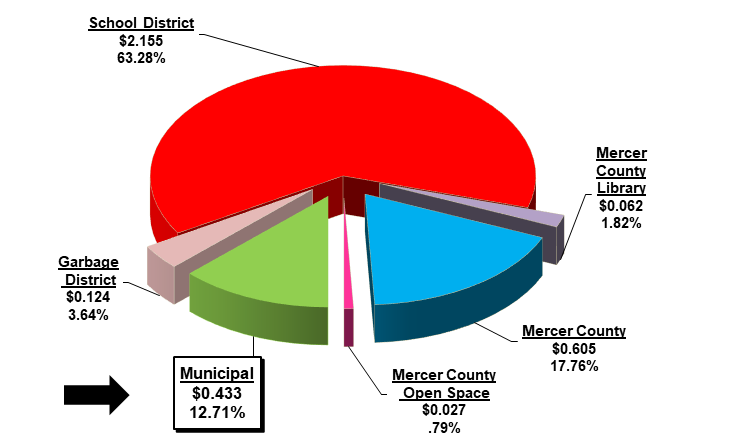

Property taxes in Jersey City are calculated based on the Total Assessed Value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Generate Reports Mailing Labels - Maps Include. City of Jersey City Assessors Office Services.

Please call the assessors office in Jersey City before. TAXES BILL 000 000 50000 0 000 2034 4. Several government offices in Jersey and New.

11605 00001. For the past 4 years Ive been researching and writing about property taxes and revaluation among other topics on CivicParent. Online Inquiry Payment.

Object moved to here. The assessed value is determined by the Tax Assessor. Free Comprehensive Details on Homes Property Near You.

Jersey City establishes tax levies all within the states statutory rules. The City of Union City announces the sale of. JERSEY CITY NJ 07302 Deductions.

Online Inquiry Payment. Tax Zoning Flood Aerial GIS and more. City of Jersey City.

The short-term 5 year abatements pay regular tax but at reduced levels for 5 years eg 20 of tax in Year 1 40 in Year 2 and so onuntil by Year 6 the building pays full regular tax. 2020-2021 and prior year delinquent taxes. 30 MONTGOMERY STREET LPay Date.

Real estate evaluations are undertaken by the county. Enter an Address to Receive a Complete Property Report with Tax Assessments More. Tax amount varies by county.

The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year. The City of Jersey City Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within City of Jersey City and may establish the amount of tax due on that property based on the fair market value appraisal. Value all real and personal property in the city for the purposes of assessment and taxation in accordance with general law the Charter and applicable provisions of the Jersey City Code.

A Jersey Property Records Search locates real estate documents related to property in Jersey New Jersey. There is a 2 fee for all checks returned for insufficient funds. TAXES BILL 000 000 55321 0 000 2022 3.

Ad Search County Records in Your State to Find the Property Tax on Any Address. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. The tax rate is set and certified by the Hudson County Board of Taxation.

11 rows City of Jersey City. Account Number Block Lot Qualifier Property Location 683385 10901 0003701 63-67 HENRY ST. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

City of Jersey City. Ad Just Enter your Zip Code for Assessed Values in Your Area. NJ Property Tax Records Search Search - NJ Tax Maps Property Records Ownership Assessment Data Real Estate Info Sales History Comparable Properties.

Expert Results for Free. TAXES BILL 000. New Jerseys median income is 88343 per year so the median yearly property tax paid by New Jersey.

The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation. We do not make copies of checks. A listing of all parcels delinquencies and.

Costs along with bidding instructions please visit. THE OFFICE OF THE CITY ASSESSOR SHALL.

Tax Assessor Paterson New Jersey

New Jersey Business Personal Property Tax A Guide

Tax Finance Dept Sparta Township New Jersey

Property Tax Info Township Of Irvington New Jersey

Township Of Teaneck New Jersey Tax Collector

City Of Cape May Nj Tax Assessment

Official Website Of East Windsor Township New Jersey Tax Collector

Tax Collector S Office City Of Englewood Nj

Township Of Nutley New Jersey Property Tax Calculator

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Nj Tax Records In Berlin Borough New Jersey Pg 7 Berlin Camden County Records

The Official Website Of City Of Union City Nj Tax Department

Township Of Nutley New Jersey Property Tax Calculator

The Official Website Of The Township Of Belleville Nj Tax Collector